Password Security & Compliance

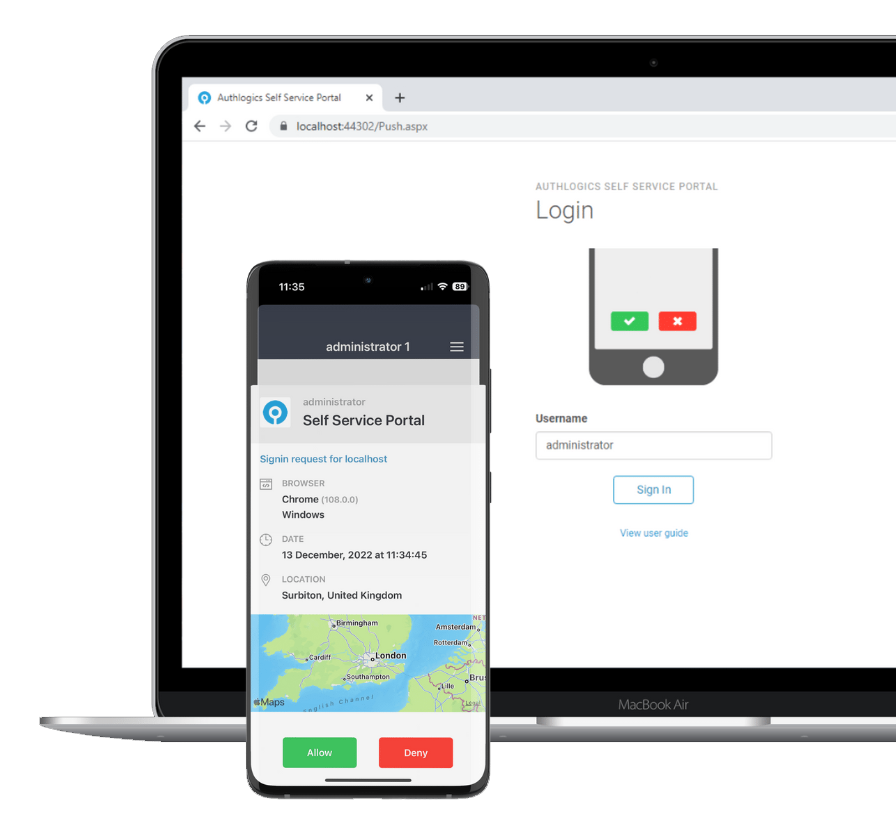

Automated Real-Time Protection

Simplified Authentication

Ultimate User Login Experience

Day-One Deviceless Access

Rapid Deployment, Ease of Integration

Identity Verification

Customer Cost & Risk Reduction

Login Adaptability

Cloud & On-Prem Hybrid Versatility

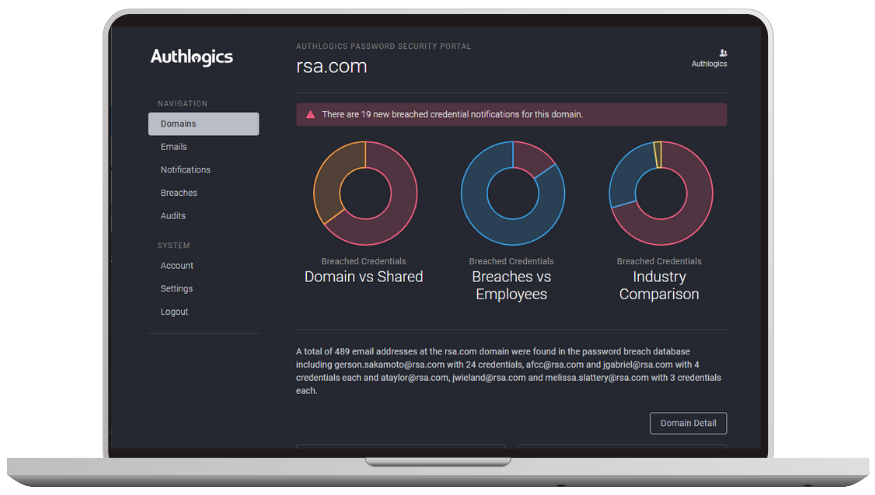

Password Breach Database

Identify poor password practices

Password Security Audit

Assess your Active Directory

Password Security Management

Real-time protection and remediation

Demo Videos

See Authlogics in action

Resources

Datasheets, case studies and whitepapers

Blog

News and information updates

Cost Saving

Calculate the benefits